The Schwab US Dividend Equity ETF (SCHD) is our fund of the week. The fund soared to a record high on Monday as American stocks continued their bull run as the quarterly earnings season continued.

The ETF jumped to a high of $80, crossing the previous all-time high of $79.92. This rebound happened as other popular funds that track the S&P 500, Nasdaq 100, and Dow Jones also rallied to their record high.

Donald Trump shooting and Fed

There were three main catalysts for the SCHD ETF. First, the assassination of Donald Trump raised the probability that he would win the general election in November. Most polls show that Trump has an edge against Joe Biden if he is the nominee.

Donald Trump is viewed positively by market participants because he has vowed to cut taxes and lower regulations. However, he has also said that he will implement more tariffs, which most executives hate.

The case for Trump intensified on Monday after a federal judge threw out his classified documents case being prosecuted by Special Counsel Jack Smith.

Second, the SCHD ETF has done well as investors focused on the recent weak economic numbers from the United States. A report by the ISM showed that the manufacturing and services PMIs dropped below the expansion zone of 50 in June.

Last week, data showed that the country’s inflation dropped to 3.0% in June and is moving in the right direction. Therefore, there are signs that the Federal Reserve will start cutting interest rates as soon as in its September meeting.

Stocks do well when the Fed is turning bearish. As a dividend-focused ETF, SCHD will benefit when rates start falling because risk-averse investors in money-market funds will move to dividend stocks, which are yielding more.

This trend explains why the SCHD has continued to see inflows in the past few months. Data by ETF.com shows that the fund has added over $1.8 billion this year, bringing its total assets to over $55 billion.

SCHD ETF inflows

The next key catalyst for the SCHD ETF will be the second quarter corporate earnings. Already, companies like JPMorgan, Citigroup, Delta Air Lines, and Blackrock have published their financial results.

Looking ahead, companies like Bank of America, UnitedHealth, Morgan Stanley, and Johnson & Johnson will publish their earnings. While these stocks are not SCHD constituents, they will have an impact on most US ETFs.

SCHD ETF technical analysis

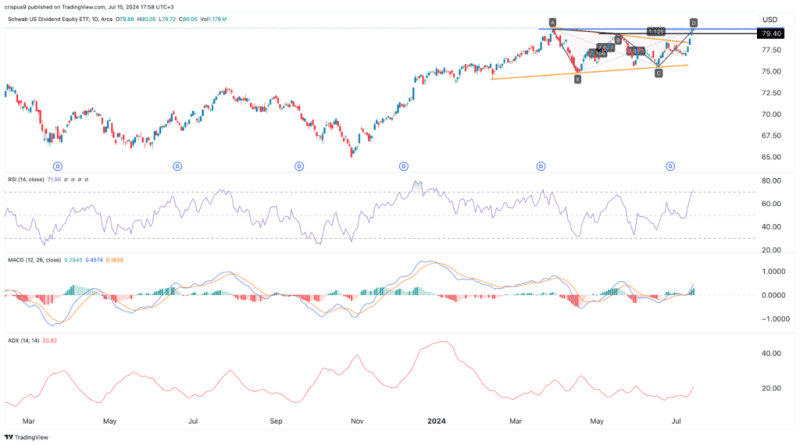

The Schwab US Dividend Equity ETF is our chart of the week because of its recent performance. It was forming a symmetrical triangle pattern and flipped the upper side on Friday.

The fund has also risen for six straight days and is now sitting at its all-time high. It has also jumped above the 50-day and 100-day Exponential Moving Averages (EMA).

The fund has also flipped the important resistance point at $79.40, its highest swing on May 15th. It has also formed a harmonic chart pattern and is sitting at its highest point.

At the same time, the MACD indicator has pointed upwards while the MACD indicator has risen above the neutral point. The Average Directional Index (ADX) has moved above 50, signaling that the trend is gaining strength.

Therefore, the ETF will likely continue rising as buyers target the next key resistance point at $85.

However, as I have written before, while the SCHD ETF is a good fund to invest in, it has a history of underperforming the market. As such, I believe that it should be bought to complement other growth-focused funds like SPY and QQQ.

The post ETF chart of the week: SCHD stock soars to a record high appeared first on Invezz