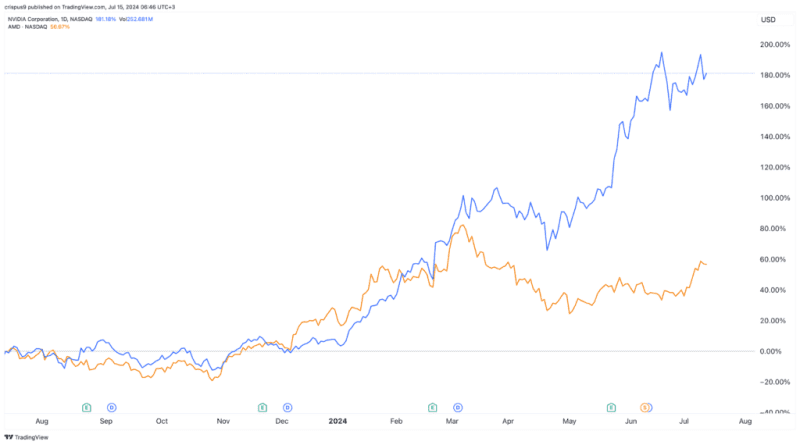

AMD (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA) stock prices have decoupled this year. Nvidia has gone bonkers and surged by over 160% this year, reaching a $3 trillion valuation while AMD has risen by just 26%.

AMD vs Nvidia stocks

Expert delivers an optimistic Nvidia forecast

Analysts have a mixed opinion about Nvidia stock now that it has surged this year. Some analysts, I included, believe that Nvidia is a highly overvalued company that will ultimately drop as we saw with Tesla and Cisco during the dot com bubble.

Other experts believe that Nvidia shares have more runway for growth. In a statement to the Financial Times, James Anderson, a well-known investor who spotted opportunities in Tesla and Amazon said that it could become a $50 trillion giant.

Anderson, who now runs a $650 million fund, said that Nvidia had an opportunity to corner the artificial intelligence (AI) industry. Specifically, he cited the company’s advancements in hardware industry through its GPUs and the software side through its Compute Unified Device Architecture (CUDA) software. He said:

“The potential scale of Nvidia in the most optimistic outcome is both way higher than I’ve ever seen before and could lead to a market cap of double-digit trillions.”

Nvidia has emerged as one of the fastest-growing companies in the world. In its recent earnings, its revenue grew by over 200% in the last quarter, reaching over $26 billion, higher than the $16 billion it made in the whole of 2021.

Analysts believe that Nvidia will continue this trend, with the second quarter revenue expected to come in at over $26 billion. Its full-year revenue is expected to be $110 billion followed by $149 billion in 2025.

Still, a $50 trillion market valuation seems quite optimistic since the global GDP currently sits at over $100 trillion.

AMD stock could benefit

If Anderson’s prediction is correct, then it means that Advanced Micro Devices (AMD) will also be a top beneficiary of this trend.

Like Nvidia, AMD has done well in the past decade as it transformed from a small semiconductor company into a $293 billion juggernaut.

The company spun out its GlobalFoundries business in 2012 and became a fabless semiconductor company like Nvidia. Under Lisa Su, AMD has become an innovation giant that has taken market share from Intel.

AMD has recently moved deeper into the artificial intelligence industry by launching several products. It launched Radeon GPU that competes directly with Nvidia’s H100. It also launched AMD Ryzen CPUs that have advanced AI capabilities.

Therefore, as AI chips supply remain lower than demand, there is a likelihood that AMD will take some market share. Some analysts believe that AMD can capture about 10% of the global AI industry, which is substantial.

Potential risks ahead

Still, the main risk for AMD is that its growth is not going on well for now. Analysts expect that AMD’s revenue dropped by 2.30% in the second quarter to $5.24 billion. For the year, they expect that its revenue will jump by just 3.30% to $23.43 billion.

AMD spots significant valuation metrics with a forward PE ratio of 125, higher than the sector median of 30. Its forward EV to EBITDA ratio stands at 44.75, higher than its five-year average of 36. As such, the company will need to execute well to justify this valuation.

The other risk is that demand for data center GPUs will start to slow now that companies like Microsoft, Amazon, and IBM have been buying tons of them. This could be a sign that we are at the upper side of the cycle as we saw with electric vehicles (EV) a few years ago.

Looking forward, the next key dates to watch will be on July 30th when AMD will publish its financial results. Intel, another competitor will publish its results on August 1st while Nvidia will publish on August 21st.

The post AMD stock price to benefit from Nvidia’s $50 trillion forecast appeared first on Invezz